09 Feb Legislation that could cut health insurance premiums 50% or more

Sound too good to be true?

By Grant Dattilo

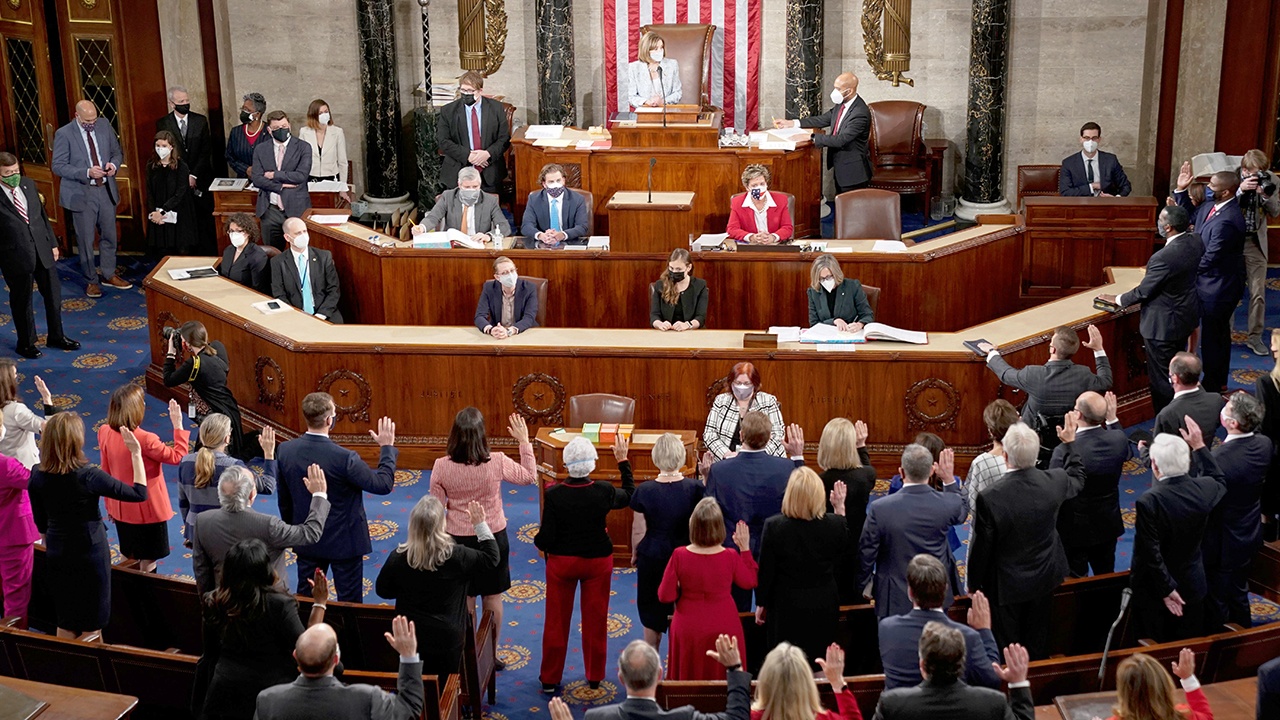

Some legislators and members of Congress are proposing a new health plan that could cut your premiums in half. They hear you asking for help!

In 2020, the average annual cost of a family health insurance plan provided by an employer reached $20,576, according to Kaiser Family Foundation. That’s far too expensive, and everyone knows it.

Legislators hear the complaints that insurance is too expensive and want to do something about it. Despite public rhetoric to the contrary, blaming insurance companies for the high cost of insurance misses the point. The prices providers charge for medical and mental health care determine 80-85 percent of the insurance premium cost.

So, Let’s Go to a Public Option

A popular theory among some legislators is to create a government-run health insurance option that would compete with private, commercial insurance. This idea goes by many names. Supporters might say “Medicare for All” or the less threatening term, Public Option.

Public Option plans rest on the idea that governments can directly negotiate provider payments, bypassing insurance companies. This idea suggests that insurance companies’ revenue is a primary driver of high insurance cost. Public Option adherents believe government can manage health insurance at less cost than private insurance companies, hence a savings.

The Affordable Care Act set the limit on how much an insurance company can retain of premiums. For individual and small group insurance, the company is limited to no more than 20 percent of premium, and for large group, 15 percent. This means that all of the insurance company’s expenses, plus residual earnings cannot exceed 20 or 15 percent of premium.

Government-run health plan supporters cite Medicare, showing that CMS spends less than four percent administering the program. This, they suggest, means a Public Option could save 11-16 percent or more of premium. That would be great, if true.

According to the Congressional Budget Office,[i] at least eight federal government departments, outside of the Centers for Medicare and Medicaid (CMS), spend money regulating and providing government-run medical care, and some portion of those costs are attributable to Medicare. Yet, those costs are not reported as Medicare administrative expenses.

Secondly, and more importantly, CMS contracts with non-government third party entities, including insurance companies, to administer the Medicare program. When an insurance company administers Medicare claims, it does little to validate those claims—called adjudication. This could explain the high rate of fraudulent claims paid associated with Medicare and Medicaid, estimated by some at a rate greater than 10 percent.

Privately insured individuals often discover “the hard way” that insurance companies aggressively adjudicate claims. In fact, this adjudication process often is the basis for consumer complaints. By careful adjudication, private insurance companies can reduce the number and cost of fraudulent claims, and often enough, deny claims, causing disputes with Members.

It is cheaper to administer claims when all the third party does is pay them, not adjudicate them. The fact is, health care administration costs money, and having government employees do the work does not eliminate or reduce the cost.

How a Public Option Might Save Money

We contend that the reason health care costs so much is determined by the price of care, and its frequency, not the comparative cost of private versus government-run health insurance. This idea is easy to demonstrate.

Providers today, according to a broad range of sources, are paid 160-350 percent of Medicare for many medical care and surgical services. Some outliers, like anesthesiologists and radiologists, might receive 1,000 percent of Medicare, or even more, for their services.

If Medicare pays a physician $100 for a simple exam, for its privately insured members, the insurance companies will pay $160 to $285 (or more). If Medicare pays a hospital $10,000 for a surgical procedure, private insurance will pay, on average, $24,700. This ratio, which we call the Medicare-Percent, is true for all provider payments by private insurance companies—they exceed Medicare payments by a wide margin.

Hence, the Public Option, a government-run and enforced health insurance plan, can only substantially reduce premiums by paying providers at the Medicare (or less) rate. If the health plan pays less, then the cost of insurance will be less.

Some of the Public Option health plans we have reviewed suggest provider payments could even be less than the Medicare rate.

The only way that a Public Option can reduce premiums is to pay providers less than private insurance pays. Private insurance could never compete with a government-run plan that pays so little to providers.

The Flaw in the Ointment

Legislators in Minnesota recognize that today’s professional providers could not afford to take patients enrolled in a public-option health plan, and it is likely they would refuse them. Hence, legislators have proposed studying whether to require all providers, as a matter of licensure, to accept Medicare, Medicaid, and Public Option enrollees. In other words, to practice medicine, the physician would be required to take a 50 percent or more cut in pay.

The first physicians to leave the practice of medicine would be the more experienced, and highly paid doctors. One could presume they would be replaced by less skilled, less experienced non-physicians who earn far less than individuals with an M.D. degree and 10-15 years or more experience in a medical or surgical specialty study.

With a Public Option plan, you’ll pay 50 percent or less of the premium of today. That is true and paying less is vitally important. But you will wait many months for a joint replacement surgery, and it will be done by a less skilled surgeon than today. You may find yourself in a queue to secure a primary care practitioner and that practitioner will likely not be a board-certified, Medical Doctor with 30- or 40-years’ experience.

Here’s the point about the Public Option

With a Public Option plan, you’ll pay 50 percent or less of the premium of today. That is true and paying less is vitally important. But you will wait many months for a joint replacement surgery, and it will be done by a less skilled surgeon than today. You may find yourself in a queue to secure a primary care practitioner and that practitioner will likely not be a board-certified, Medical Doctor with 30- or 40-years’ experience.

Imagine living in a rural area which today is already struggling to support a single physician. Then, the government launches a Public Option health plan with premiums at half of today’s high cost. The single physician watches as her patients choose the popular, cheaper new plan, and she suffers a drop in reimbursements by 40-60 percent. Soon after, she finds a new career and the local residents would lose their physician. The community might hire a Nurse Practitioner to replace the physician, but for sure, patients would have to drive farther to see an M.D.

Yes, we must find ways to reduce insurance premiums. (We’ve already done this for our clients. And we have many more ideas.)

And yes, a Public Option health plan would reduce insurance premiums—maybe by a lot. But paying half as much and expecting the same quality of and access to care as today is not possible.

We are actively monitoring legislative and congressional action dealing with insurance and health care reform. We will update you as more discussion surfaces about the Public Option. For now, be leery of it.

[i] Congressional Budget Office (CBO) report on insurance options. December, 2008.