15 Sep Why not Benefit Employees, Not Insurance Companies?

By Grant Dattilo

Going forward, affordable health care benefits require increased price transparency, but more than price is needed. Also necessary are new group insurance strategies – like the BENIC plan.

Previous articles described a way to determine the price of care with a single number. And we explained the Good Faith Estimate that you can obtain before receiving care.

Now we show you what insurance companies don’t want you to know.

At stake for insurance companies

Federal law sets a maximum percentage that insurance companies can keep of premiums they collect to cover all their internal expenses. For small employer the law allows insurance companies to keep up to 20% of premiums (50 or fewer employees). For large employers – more than 50 employees – insurance companies can keep up to 15% of premiums.

The total premiums paid will determine the dollars the insurance company can retain. The higher the premium, the more cash retained.

Here are two examples for a small group:

A health plan with a total health insurance premium of $1 million:

- 20% for administration means the insurance company can retain up to $200,000.

- $800,000 of the total is projected to pay claims.

A stripped-down plan with premiums of $500,000:

- 20% for administration means the insurance company can only keep $100,000.

- $400,000 of the total is projected to pay claims.

The insurance company’s goal is to retain maximum revenue from premiums collected. If an insurance company can convince an employer to pay $1 million in premiums instead of $500,000, the insurance company’s administrative net revenue will double.

In contrast, employers and employees want to pay the least amount in premiums. Their goal is to pay enough so that funds are available to pay claims under the terms and structure of the health plan, but without overpaying premium.

Employer’s Goal Realized

How can employers keep a high enough level of benefits to attract and retain employees while paying less to the insurance company? The answer is “The BENIC Plan.” (https://benicplan.com)

BENIC means “Benefit Employees, Not Insurance Companies.” It’s become very popular with employers and employees because:

- The employee health benefits remain rich and comprehensive.

- Payroll deductions are generally less – sometimes much more.

- Employees and their families have more affordable options.

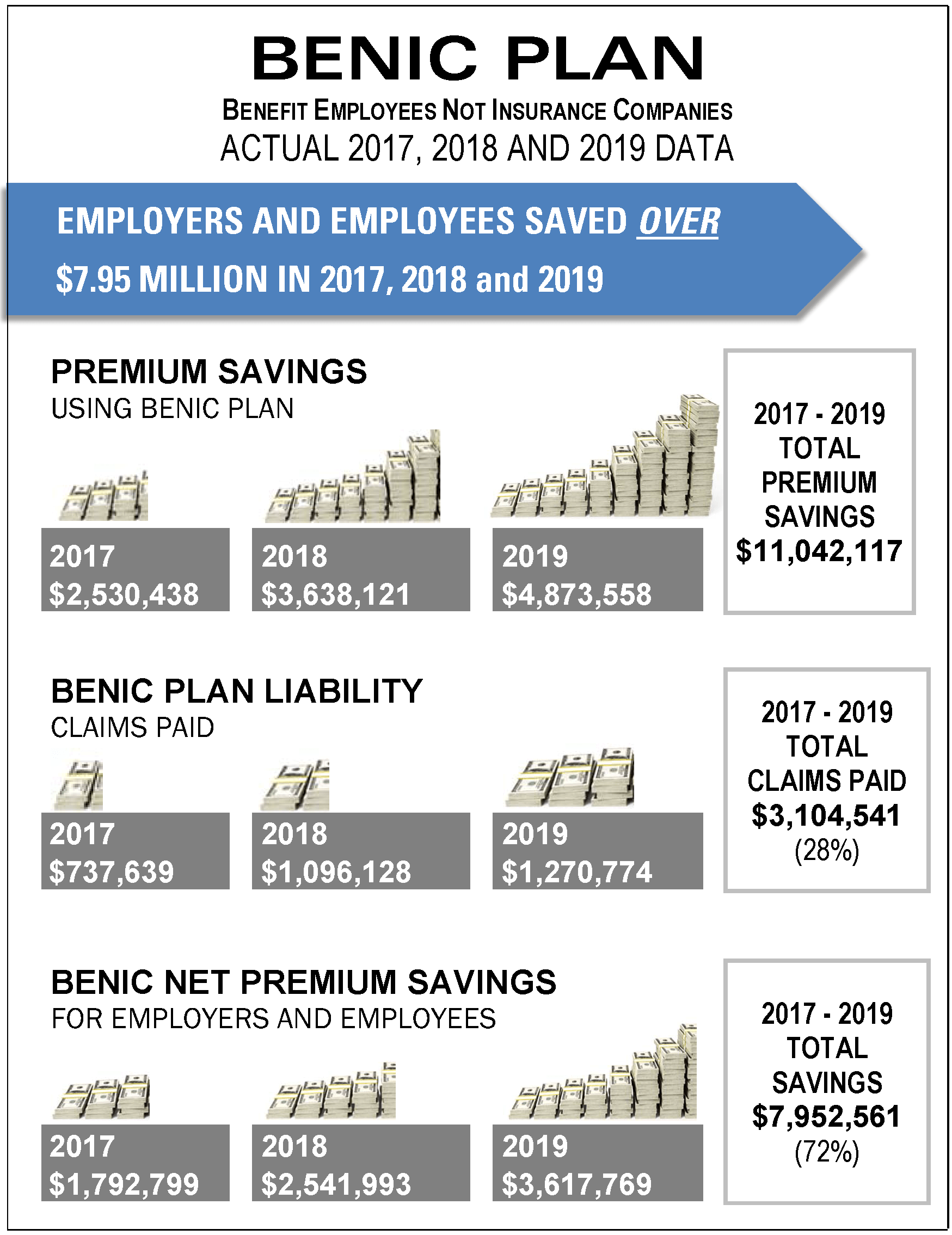

During 2017-2019, DCI’s BENIC Plan saved employers and employees almost $8 million in premiums, while retaining and attracting employees with its rich benefits. Questions? Email [email protected].

See the table below.

The information in this article is the property of Dattilo Consulting, Inc. and may not be reproduced in part or whole without express written permission of DCI.