18 May IRS Sets 2023 Limits for HSAs, HDHPs, and HRAs – How does this affect you?

By Grant Dattilo

Employers and employees—anyone who purchases health insurance—can spend less on insurance premium and gain more control over spending decisions. How? With a Health Savings Account (HSA) paired with a High Deductible Health Plan (HDHP). These accounts are subject to I.R.S. limits, which are updated each year.

The new limits for 2023

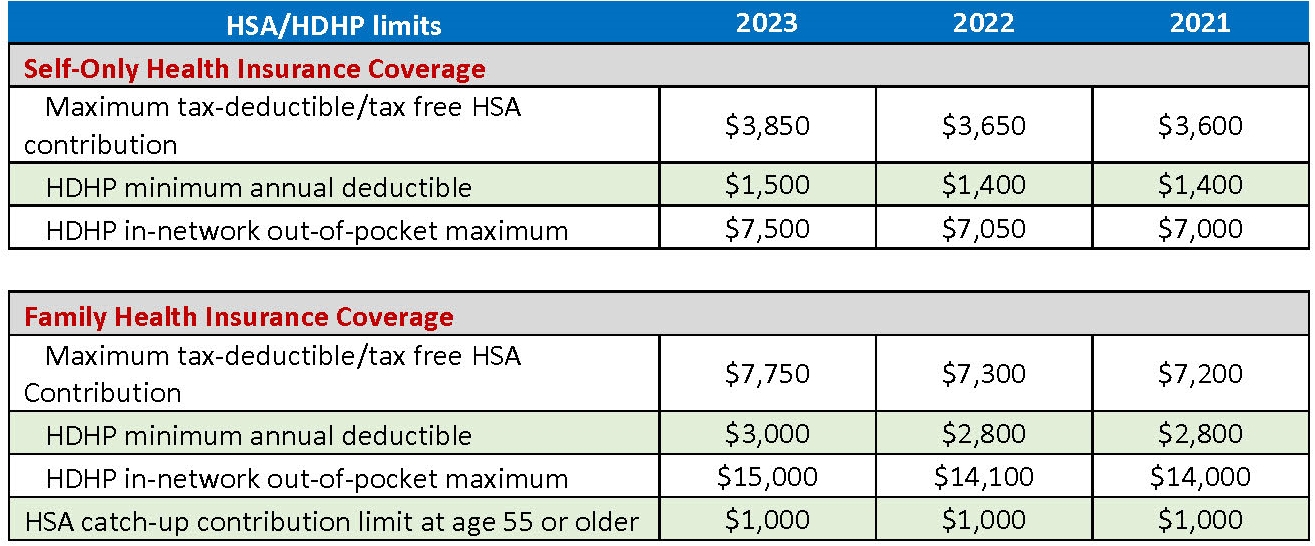

For 2023, these are the IRS allowable limits compared with 2022 and 2021.[i]

HSAs and HDHPs offer valuable tax preferences

HSA account holders are not taxed on money deposited to their HSA, up to the allowable amounts (in the above table). Employers and individual HSA accountholders are both allowed to contribute those funds, and both receive significant tax reductions as a result.

If the funds are spent on products and services authorized by the IRS, the account holder is buying them with tax-preferred dollars. There is quite a generous list of expenses for which you can spend your HSA dollars.

The 2020 Federal CARES Act added “over-the-counter” medications to the list. You might be surprised that you can use your HSA to purchase sunscreen, first aid, lip balm, aloe vera, prescription glasses, athletic tape and wraps, and a new fitness tracking device.[ii] Find a more complete list of these eligible expenses here.

The funds in the HSA belong to the account holder–always–and are part of the account holder’s estate at death.

Plan design is important

The HSA is paired with a qualified High Deductible Health Plan (HDHP). The IRS sets a minimum annual deductible and a maximum out-of-pocket amount. The maximum out-of-pocket amount increased by $450 over 2022, which could be alarming, but not if you have a well-conceived plan and benefit design. At DCI have design plans to take advantage of these I.R.S. provisions.

With higher deductibles, premiums will moderate. Lower deductibles, of course, result in higher premiums and mean you pay more to the insurance company. We think you should hold on to more of your premium dollars. It is why we created the BENIC Plan – Benefit Employees, Not Insurance Companies.

Employers can create even more opportunities to control medical care spending by offering a Health Reimbursement Arrangement to their employees. The HRA allows employees to be reimbursed for covered expenses without any tax implications, and the funds paid into the HRA are tax-preferred as well.

To receive a list of eligible HSA expenditures or learn more about HSAs, HRAs, and HDHPs, contact me at [email protected].

[i] Staff. (2022) Rev. Proc. 2022-24. IRS Rule on allowable contributions. 26 CFR 601.602: Tax forms and instructions. (Also Part I, §§ 1, 223; Part III § 54.9831-1). 1/31/2022. IRS, Washington, DC. https://www.irs.gov/pub/irs-drop/rp-22-24.pdf

[ii] https://financialgym.com/blog/2020/10/31/7-purchases-you-may-not-know-you-can-make-with-your-hsa-fund